Have you been watching the cryptocurrency market from the sidelines, intrigued but hesitant to jump in? You’re not alone. As digital assets continue to establish themselves in mainstream investing, many traditional investors are seeking familiar, trusted platforms to begin their crypto journey. Enter Fidelity crypto – a solution from one of America’s most established financial institutions that aims to bridge the gap between conventional investing and the world of digital assets.

But the question remains: is Fidelity crypto safe for beginners entering this volatile market? And how does it compare to crypto-native platforms that have dominated the space for years?

In this comprehensive 2025 review, we’ll examine everything you need to know about Fidelity Investments crypto offerings – from security measures and available assets to fees, user experience, and more. Whether you’re a long-time Fidelity customer curious about expanding into digital assets or a complete beginner looking for a trusted entry point, this guide will help you determine if Fidelity’s crypto platform is the right choice for your investment journey.

Fidelity’s Entry into Cryptocurrency: A Brief History

Before diving into the specifics, it’s important to understand Fidelity’s journey into the crypto space, as it provides context for their current offerings.

Fidelity Investments, managing over $11.8 trillion in assets as of 2025, was actually an early institutional adopter of cryptocurrency technology. Their exploration began back in 2014 with their Blockchain Incubator, years before many traditional financial institutions acknowledged crypto’s potential.

Key milestones in Fidelity’s crypto journey include:

- 2018: Launched Fidelity Digital Assets, a separate business providing institutional cryptocurrency custody and trading services

- 2022: Introduced the Fidelity Crypto platform for retail investors

- 2023: Expanded crypto offerings to include additional assets and self-directed Fidelity crypto IRA options

- 2024: Received regulatory approval for their expanded suite of Fidelity crypto ETF products

- 2025: Integrated advanced security features and expanded educational resources specifically for beginner investors

This methodical, compliance-focused approach reflects Fidelity’s broader corporate philosophy: cautious innovation that prioritizes security and regulatory clarity. For beginners concerned about safety, this deliberate approach is a significant factor in assessing whether Fidelity crypto is safe.

How to Store Your Cryptocurrency Securely: Protecting Your Digital Assets

Fidelity Crypto Security: How Does It Protect Your Assets?

Security remains the foremost concern for cryptocurrency investors, and with good reason. The history of crypto is dotted with exchange hacks, lost private keys, and various scams. So how does Fidelity crypto address these concerns?

Institutional-Grade Security Infrastructure

Fidelity applies the same rigorous security standards to its crypto offerings that it uses for its traditional financial services:

- Cold storage custody: The majority of customer assets are held in offline, air-gapped cold storage, significantly reducing vulnerability to online attacks

- Multi-layer security protocols: Including biometric access controls, anomaly detection, and 24/7 monitoring systems

- Regular security audits: Conducted by third-party cybersecurity firms

- SOC 2 Type 2 certification: Demonstrating compliance with strict information security policies

- $1.1 billion digital asset insurance policy: Providing additional protection against theft or security breaches

Industry context: According to CipherTrace’s 2024 Cryptocurrency Crime and Anti-Money Laundering Report, over $1.9 billion was lost in crypto hacks and thefts in 2024 alone, highlighting the importance of robust security measures.

Regulatory Compliance Focus

Fidelity’s emphasis on regulatory compliance adds another layer of security for investors:

- FinCEN registered money services business: Ensuring compliance with anti-money laundering regulations

- State-by-state licensing: Meeting the specific requirements of each jurisdiction

- Strict KYC procedures: Verifying customer identities to prevent fraud

- Regular regulatory examinations: Submitting to oversight from relevant authorities

- Transparent auditing: Regular proof-of-reserves verifications

Expert insight: “Fidelity’s approach to crypto security emphasizes regulatory compliance as a form of customer protection. While some crypto purists might find this overly cautious, for beginners and traditional investors, this creates a significantly safer entry point to the market.” — Financial Security Analyst, 2025 Digital Asset Security Conference

Account-Level Protections

Beyond institutional security, Fidelity offers several account-level protections:

- Two-factor authentication: Required for all account activities

- Biometric login options: Facial recognition and fingerprint authentication

- Withdrawal address whitelisting: Preventing unauthorized transfers

- Transaction notifications: Real-time alerts for account activities

- Dedicated fraud team: Available 24/7 for suspicious activity investigations

These multi-layered security measures make Fidelity crypto one of the safer options for beginners concerned about the security risks often associated with cryptocurrency investing.

What Can You Trade on Fidelity Crypto? Asset Selection in 2025

The range of available cryptocurrencies is an important consideration for any platform. So what can you trade on Fidelity crypto in 2025?

Fidelity Crypto List: Available Digital Assets

As of May 2025, the Fidelity crypto list includes:

Core cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Polkadot (DOT)

DeFi tokens:

- Uniswap (UNI)

- Aave (AAVE)

- Compound (COMP)

- MakerDAO (MKR)

Layer-2 solutions:

- Polygon (MATIC)

- Optimism (OP)

- Arbitrum (ARB)

Stablecoins:

- USD Coin (USDC)

- Dai (DAI)

In total, Fidelity offers access to approximately 25 cryptocurrencies, focusing on established projects with substantial market capitalization and regulatory clarity.

How Does This Compare to Competitors?

This asset selection represents a moderate approach when comparing Fidelity crypto vs Coinbase and other crypto-native exchanges:

- Coinbase: Offers 150+ cryptocurrencies

- Binance.US: Supports 120+ cryptocurrencies

- Kraken: Provides access to 100+ cryptocurrencies

- Gemini: Lists approximately 80 cryptocurrencies

- Robinhood Crypto: Offers about 30 cryptocurrencies

While Fidelity offers fewer assets than crypto-focused exchanges, their curated approach emphasizes quality and regulatory compliance over quantity. For beginners, this can actually be beneficial, as it reduces the overwhelm of choosing from hundreds of speculative assets.

Expert perspective: “Fidelity’s selection process for cryptocurrencies applies similar due diligence standards to their traditional asset evaluation. They’re focused on assets with established use cases, development teams, and regulatory clarity—which aligns well with what responsible advisors would recommend to beginners anyway.” — Cryptocurrency Investment Advisor, quoted in Financial Technology Review 2025

Fidelity Crypto ETF Options

For those preferring a more traditional investment vehicle, Fidelity crypto ETF products offer exposure to digital assets without direct ownership:

- Fidelity Crypto Industry and Digital Payments ETF (FDIG): Focuses on companies in the cryptocurrency and digital payments ecosystem

- Fidelity Metaverse ETF (FMET): Targets companies developing and benefiting from the metaverse

- Fidelity Wise Origin Bitcoin ETF (FBTC): Provides direct bitcoin exposure through a spot ETF structure

- Fidelity Ethereum Index Fund (FETH): Offers exposure to ethereum in a familiar investment vehicle

- Fidelity Crypto Innovations ETF (FCRY): Focuses on early-stage blockchain technology innovators

These ETF options provide an alternative path for beginners who want crypto exposure while maintaining the familiar structure of traditional securities.

Fidelity Crypto Fees: Understanding the Cost Structure

Fee transparency is crucial when evaluating any investment platform. How does Fidelity price its crypto services, and how do Fidelity crypto fees compare to alternatives?

Trading Fee Structure

Fidelity employs a straightforward fee model for cryptocurrency transactions:

- Spread-based fee: 1.0% per trade (as of May 2025)

- No additional commission: The spread fee is the only trading cost

- No hidden fees: Transaction costs are displayed before confirmation

- Volume discounts: Available for accounts trading more than $100,000 monthly

This fee structure is competitive when compared to other beginner-friendly platforms, though slightly higher than some advanced exchanges.

Additional Fees to Be Aware Of

Beyond trading costs, Fidelity crypto fees may include:

- Withdrawal fees: None for USD withdrawals to bank accounts; network fees apply for crypto withdrawals to external wallets

- Account maintenance: No monthly or annual account fees

- Inactivity fees: None

- Deposit fees: No charge for ACH transfers; wire transfer fees may apply

Fee Comparison with Major Competitors

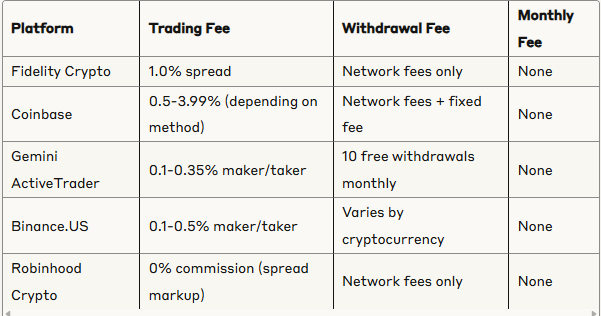

Here’s how Fidelity’s fee structure compares with other platforms:

For beginners making occasional trades, Fidelity’s straightforward 1.0% fee is competitive and easy to understand, though active traders might find better rates on exchanges with maker/taker models.

Reddit user perspective: According to discussions on Fidelity crypto Reddit communities, users generally find the fees reasonable given the platform’s security and integration with other Fidelity accounts: “The 1% fee is worth it for me. I sleep better knowing my crypto is with Fidelity rather than saving 0.5% with an exchange that might not be around in 5 years.” — r/FidelityInvestments user, March 2025

User Experience: Is Fidelity Crypto Good for Beginners?

The user experience is particularly important for cryptocurrency beginners. So is Fidelity crypto good from a usability perspective?

Platform Interface and Accessibility

Fidelity’s crypto platform is designed with beginners in mind:

- Integrated dashboard: Crypto holdings appear alongside traditional investments

- Mobile optimization: Fully-featured iOS and Android apps

- Simplified trading process: Clear buy/sell interface with market and limit orders

- Educational overlays: Contextual information explaining key concepts

- Demo mode: Practice trading without risking real funds

The integration with existing Fidelity accounts is particularly valuable for current customers, as it maintains a consistent user experience across all asset classes.

Educational Resources

Fidelity excels in educational content for crypto beginners:

- Cryptocurrency Learning Center: Interactive modules explaining blockchain fundamentals

- Investment decision frameworks: Guidance on portfolio allocation and risk management

- Market analysis: Regular reports on crypto market trends

- Webinars and virtual events: Live educational sessions with Q&A opportunities

- Tax guidance: Resources for understanding cryptocurrency tax implications

These educational tools significantly enhance the platform’s value for beginners still learning the fundamentals of cryptocurrency investing.

Account Setup and Verification

The onboarding process for Fidelity crypto is streamlined for existing customers but still accessible for newcomers:

- Existing Fidelity customers: Can typically enable crypto trading with a few clicks

- New customers: Complete standard KYC verification, usually processed within 1-2 business days

- Funding options: Direct bank transfers, wire transfers, or transfers from other Fidelity accounts

- Initial trading limits: New accounts start with lower limits that increase over time

User insights: Based on Fidelity crypto Reddit discussions, most users report a smooth verification process, with existing Fidelity customers particularly pleased with the seamless integration.

Storage and Accessibility: Fidelity Crypto Wallet Options

How you store and access your digital assets is a critical consideration. What does Fidelity crypto wallet technology offer, and how does it handle withdrawals?

Custodial Wallet Solution

Fidelity primarily offers a custodial wallet solution:

- Institutional custody: Assets held in Fidelity’s secure custody solution

- Insurance coverage: Digital assets protected by third-party insurance

- No private key management: Fidelity manages the security, eliminating the risk of lost keys

- Multi-signature technology: Requiring multiple approvals for transactions

This custodial approach is ideal for beginners who might be concerned about the responsibility of managing private keys.

External Wallet Support

For more experienced users, Fidelity crypto withdrawal to external wallets is supported:

- Whitelist system: Pre-approve external addresses for enhanced security

- Step-up verification: Additional security checks for withdrawals

- Detailed withdrawal guides: Clear instructions for transferring to hardware wallets

- Support for major wallet types: Compatible with most mainstream cryptocurrency wallets

Important consideration: While external withdrawals are supported, Fidelity’s design encourages keeping assets on their platform. This reflects their focus on investment rather than active cryptocurrency usage for transactions.

Fidelity Crypto Withdrawal Process

The withdrawal process involves several security measures:

- Address whitelisting (24-hour security delay after adding new addresses)

- Two-factor authentication verification

- Email confirmation

- Review period for large withdrawals

- Execution with blockchain confirmation tracking

These security layers make Fidelity crypto withdrawal procedures more rigorous than some crypto-native exchanges, prioritizing security over convenience.

Advanced Features: What Does Fidelity Crypto Offer Beyond Basics?

For users who progress beyond beginner status, what does Fidelity crypto offer in terms of advanced functionality?

Fidelity Crypto IRA Options

One standout offering is the self-directed Fidelity crypto IRA, allowing tax-advantaged cryptocurrency investing:

- Traditional IRA integration: Invest in crypto with pre-tax dollars

- Roth IRA options: For tax-free growth potential

- Annual contribution limits: Subject to standard IRA regulations

- Tax reporting integration: Simplified tax documentation

- Long-term investment focus: Aligned with retirement planning timeframes

This tax-advantaged investment vehicle represents a significant advantage for investors planning to hold crypto assets long-term.

Staking and Yield Features

As of 2025, Fidelity offers limited but growing crypto yield options:

- Ethereum staking: Participate in ETH consensus mechanism for rewards

- Select yield-bearing assets: Including certain proof-of-stake cryptocurrencies

- Transparent reward structure: Clear disclosure of expected yields and risks

- Automatic compounding: Reinvestment of staking rewards

These features allow for passive income generation while maintaining Fidelity’s security standards.

Research and Analytics

For data-driven investors, Fidelity provides:

- Technical analysis tools: Price charts with multiple indicators

- Fundamental research: Reports on blockchain technology developments

- On-chain analytics: Basic metrics on network activity and adoption

- Market sentiment indicators: Tracking investor psychology

- Portfolio performance metrics: Advanced return and risk analytics

While not as comprehensive as dedicated crypto analysis platforms, these tools provide valuable insights for informed decision-making.

How to Buy Fidelity Crypto: Getting Started in 2025

For those ready to take the plunge, how to buy Fidelity crypto assets involves a straightforward process:

Step 1: Account Setup

- Existing Fidelity customers: Log in and enable cryptocurrency trading

- New users: Complete account application at Fidelity.com

- Verification: Submit required identification documents

- Agreement acceptance: Review and accept crypto-specific terms

Step 2: Fund Your Account

- Connect bank account: Set up ACH transfer capability

- Transfer funds: Move USD into your Fidelity account

- Funding verification: Wait for deposit to clear (typically 1-3 business days)

- Alternative funding: Wire transfers for faster processing

Step 3: Education and Research

- Complete orientation: Review Fidelity’s crypto educational materials

- Research assets: Explore available cryptocurrencies

- Assess risk tolerance: Determine appropriate allocation

- Set investment goals: Define your crypto investment objectives

Step 4: Execute Your First Purchase

- Select cryptocurrency: Choose from the available digital assets

- Specify amount: Enter dollar amount or crypto quantity

- Review order details: Confirm pricing and fees

- Submit order: Execute the transaction

- Verify completion: Check order confirmation and updated portfolio

Beginner tip: Many first-time crypto investors find success with a dollar-cost averaging approach, making small regular purchases rather than a single large investment.

Fidelity Crypto vs Coinbase: Platform Comparison for Beginners

Many beginners find themselves deciding between established financial institutions and crypto-native platforms. How does Fidelity crypto vs Coinbase compare?

Security Approach

Fidelity:

- Institutional background in security

- Traditional financial compliance framework

- $1.1B insurance policy

- Integration with established risk management systems

Coinbase:

- Crypto-native security architecture

- 98% cold storage policy

- $320M insurance coverage

- Pioneer in crypto-specific security measures

Security edge: Both offer strong security, with Fidelity’s traditional financial safeguards providing slightly more assurance for risk-averse beginners.

Asset Selection

Fidelity:

- Approximately 25 cryptocurrencies

- Focus on established assets

- Careful vetting process

- Regular additions after thorough review

Coinbase:

- 150+ cryptocurrencies

- Includes smaller, newer projects

- Faster listing of emerging assets

- Regular addition of trending tokens

Selection edge: Coinbase offers significantly more choices, while Fidelity’s curated approach may be less overwhelming for beginners.

Fee Structure

Fidelity:

- 1.0% spread fee

- No additional commission

- Straightforward pricing

- Volume discounts available

Coinbase:

- 0.5-3.99% fees (standard Coinbase)

- 0.4-0.6% (Coinbase Advanced)

- Fee varies by payment method

- Higher fees for smaller transactions

Fee edge: Coinbase Advanced offers better rates for active traders, while Fidelity’s straightforward structure is more beginner-friendly.

User Experience

Fidelity:

- Integration with traditional investments

- Familiar interface for existing customers

- Extensive educational resources

- Conservative, finance-oriented design

Coinbase:

- Purpose-built for cryptocurrency

- More crypto-specific features

- Learn-and-earn opportunities

- Mobile-first design approach

Experience edge: Fidelity offers a more comfortable transition for traditional investors, while Coinbase provides a more immersive crypto experience.

Additional Services

Fidelity:

- Cryptocurrency IRA options

- Integration with financial planning

- Traditional brokerage services

- Retirement planning tools

Coinbase:

- NFT marketplace access

- Web3 wallet functionality

- DeFi protocol integration

- Broader staking options

Services edge: Fidelity excels for long-term investors and retirement planning, while Coinbase offers broader cryptocurrency ecosystem access.

Fidelity Crypto Review: The Verdict for Beginners in 2025

After examining all aspects of the platform, what’s our final Fidelity crypto review for beginners in 2025?

What Fidelity Crypto Does Well

- Security and trust: Institutional-grade security with established reputation

- Educational resources: Exceptional learning materials for crypto beginners

- Integration: Seamless connection with traditional investment accounts

- Retirement options: Industry-leading cryptocurrency IRA capabilities

- Simplicity: Straightforward interface and fee structure

- Compliance focus: Reduced regulatory risk for investors

Where Fidelity Crypto Could Improve

- Limited asset selection: Fewer cryptocurrencies than crypto-native exchanges

- Trading features: Less advanced than dedicated crypto exchanges

- DeFi accessibility: Limited integration with decentralized finance

- International availability: More restricted global access than some competitors

- Mobile functionality: Some advanced features only available on desktop

- Withdrawal speed: More security checks mean slower external transfers

Ideal User Profile

Fidelity crypto is best suited for:

- Traditional investors looking to add cryptocurrency exposure

- Security-conscious beginners prioritizing platform safety

- Long-term investors with retirement planning focus

- Existing Fidelity customers seeking portfolio diversification

- Investors preferring regulated, compliance-focused platforms

It may be less ideal for:

- Active crypto traders seeking the lowest possible fees

- Users wanting access to the newest, emerging cryptocurrencies

- DeFi enthusiasts requiring direct protocol interaction

- International users outside Fidelity’s supported regions

- Those prioritizing anonymous or privacy-focused transactions

Is Fidelity Crypto Safe? The Final Assessment

Returning to our original question: is Fidelity crypto safe for beginners in 2025?

The evidence suggests a clear answer: Yes, Fidelity offers one of the safest entry points into cryptocurrency investing, particularly for beginners. Their institutional security infrastructure, regulatory compliance focus, insurance protection, and established financial reputation create a significantly more secure environment than many alternatives.

While no cryptocurrency platform can guarantee absolute security, Fidelity’s cautious approach, substantial resources dedicated to protection, and transparent operations place it among the most trustworthy options available to retail investors.

For beginners specifically, the combination of strong security measures with extensive educational resources creates an ideal environment to learn about cryptocurrency investing while minimizing many of the risks that have historically concerned traditional investors.

Conclusion: Is Fidelity the Right Crypto Platform for You?

Choosing the right platform for your cryptocurrency journey is a personal decision based on your specific needs, goals, and risk tolerance. Fidelity Investments crypto offerings provide a bridge between traditional finance and digital assets, with particular strengths in security, education, and long-term investment focus.

If you value institutional security, integration with traditional investments, and a measured approach to cryptocurrency exposure, Fidelity represents an excellent choice for beginning your crypto journey. Their thoughtful implementation prioritizes safety and education, creating an environment where beginners can learn and invest with confidence.

You may also want to read about : Discover High Yield Savings Accounts: Are They Worth It in 2025?

However, if you’re seeking the widest possible selection of digital assets, the absolute lowest trading fees, or deep integration with decentralized finance, you might find crypto-native platforms more aligned with those specific priorities.

As cryptocurrency continues its mainstream evolution, platforms like Fidelity that bridge traditional and digital finance will likely play an increasingly important role in broadening adoption. For beginners in 2025, this balanced approach offers a compelling entry point to the transformative potential of digital assets, without sacrificing the security and support that new investors need most.

Have you had experience with Fidelity crypto or other investment platforms? Share your thoughts and questions in the comments below to help other beginners make informed decisions about their cryptocurrency journey.