Imagine waking up every morning to find your cryptocurrency balance has grown overnight. Not from trading or market gains, but from steady, predictable interest payments that compound daily.

Meet Marcus, a software developer who discovered crypto interest accounts in early 2023. He moved $10,000 worth of USDC into a high-yield crypto savings platform and now earns $127 every month in passive income – money that flows in whether he’s working, sleeping, or enjoying his weekend.

You’ve probably heard whispers about people earning 8%, 12%, even 15% annual returns on their crypto holdings through specialized savings accounts. But with traditional banks offering barely 0.5% on savings, these numbers sound too good to be true.

Here’s the reality: crypto interest accounts are revolutionizing how smart investors generate passive income, but only if you know how to navigate this new financial landscape safely.

The Crypto Interest Revolution

The traditional banking system has failed savers spectacularly. While banks loan out your deposits at 6-18% interest rates, they graciously offer you 0.45% APY on savings accounts. It’s time to flip the script.

Crypto interest accounts represent a fundamental shift in how money works. By lending your digital assets to institutional borrowers, platforms can offer rates that make traditional savings look prehistoric.

According to DeFiPulse data from late 2024, the total value locked in crypto lending protocols exceeded $15.7 billion, with individual savers earning an average of 8.3% APY across major platforms.

Your money doesn’t have to sit idle anymore.

How Crypto Interest Accounts Actually Work

Unlike traditional banks that use fractional reserve lending, crypto interest accounts operate on decentralized finance (DeFi) protocols or centralized lending platforms that connect your deposits directly with borrowers.

The process is surprisingly simple:

- You deposit cryptocurrency into a verified platform

- The platform lends your crypto to institutional borrowers, traders, or DeFi protocols

- Borrowers pay interest for accessing liquidity

- You receive a portion of that interest daily or weekly

- Your earnings compound automatically

Real example: When you deposit USDC into a crypto interest account offering 9% APY, you earn daily interest on crypto equivalent to approximately $0.68 per day on every $1,000 invested.

Top-Rated Crypto Savings Platforms in 2024

1. Nexo: The Premium Choice

Nexo interest rate offerings have consistently ranked among the industry’s most competitive, with USDC rates reaching up to 12% APY for premium users.

Key features:

- Daily compounding interest payments

- NEXO USDT interest rates up to 10% APY

- Insurance coverage up to $375 million

- Instant credit lines against crypto holdings

Real user data: Sarah from Austin earns $847 monthly from her $85,000 USDC deposit at 11.9% APY.

2. BlockFi: The Regulated Leader

BlockFi pioneered institutional-grade crypto interest accounts with SEC compliance and traditional banking partnerships.

Standout benefits:

- FDIC insurance on USD deposits

- No minimum deposit requirements

- Mobile app with advanced portfolio tracking

- Interest rates up to 9.5% on stablecoins

3. Celsius Network: The Community Favorite

Despite past challenges, Celsius revolutionized the earn daily interest on crypto concept with transparent rates and community governance.

Notable features:

- Weekly interest payments

- No hidden fees or minimum balances

- Interest earned in-kind or CEL tokens for higher rates

- Advanced security with multi-signature cold storage

4. YouHodler: The European Powerhouse

Best crypto interest account contender for European users, offering unique dual-asset investment options.

Unique advantages:

- EU regulatory compliance

- Multi-coin savings with over 30 supported assets

- Turbo loans feature for leveraged investing

- Interest rates up to 12% on popular cryptocurrencies

The Math Behind Crypto Interest: Real Numbers

Let’s crunch the numbers with a crypto interest account calculator scenario:

Investment: $25,000 in USDC Platform: Nexo (Premium tier) Rate: 12% APY, compounded daily

Year 1 Results:

- Daily interest: $8.22

- Monthly interest: $250.10

- Annual interest: $3,183.40

- Total balance: $28,183.40

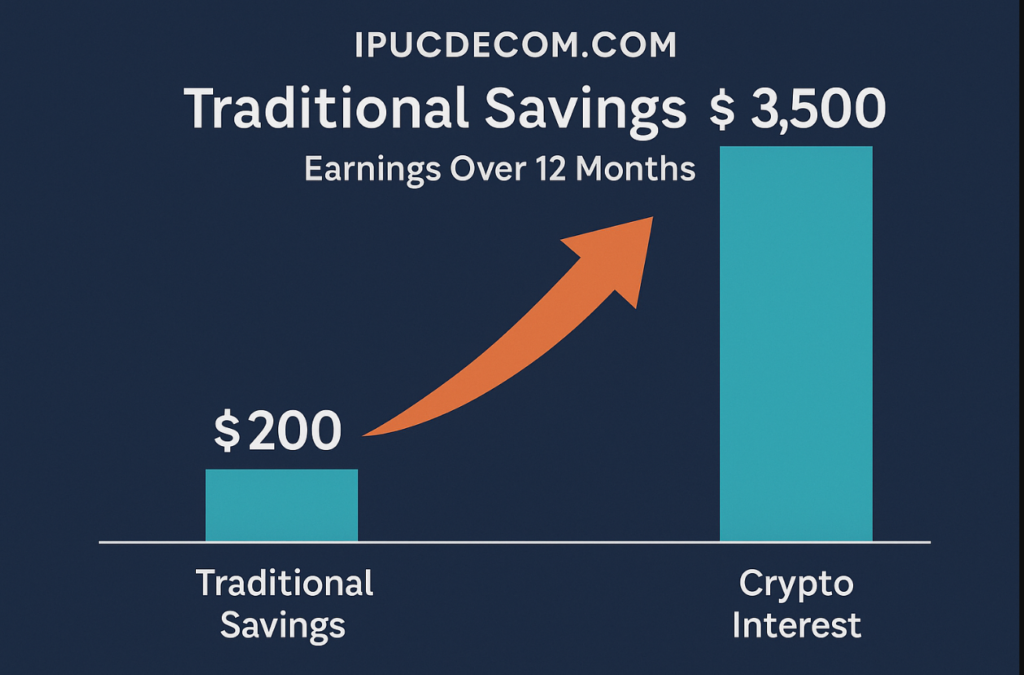

Compare to traditional savings at 0.45% APY:

- Annual interest: $112.50

- Difference: $3,070.90 more with crypto

That’s 28 times more passive income from the same principal amount.

Hidden Risks Every Investor Must Know

Risk #1: Platform Insolvency

Unlike FDIC-insured bank accounts, crypto savings account interest rate returns come with counterparty risk. If the platform fails, your deposits could be frozen or lost entirely.

Recent examples:

- Celsius filed for bankruptcy in July 2022, freezing $4.7 billion in user funds

- Voyager Digital collapsed, affecting 3.5 million users

- FTX’s downfall impacted countless crypto lenders

Risk #2: Regulatory Uncertainty

Government agencies worldwide are scrutinizing crypto lending platforms. SEC enforcement actions can shut down services overnight, as happened with BlockFi’s interest-bearing accounts in 2022.

Risk #3: Smart Contract Vulnerabilities

DeFi-based platforms face smart contract risks where coding bugs or exploits can drain funds instantly. Over $3.8 billion was lost to DeFi hacks in 2022 alone.

Risk #4: Liquidity Constraints

Some platforms impose withdrawal limits or lock-up periods that can trap your funds when you need them most. Always understand terms before depositing.

Choosing the Best Crypto Savings Account: Your Decision Framework

Step 1: Assess Platform Security

- Regulatory compliance status

- Insurance coverage details

- Security audit results

- Track record and management team

Step 2: Compare True Yields

Use a crypto interest chart to compare:

- Base interest rates across platforms

- Promotional vs. standard rates

- Minimum deposit requirements

- Fee structures

Step 3: Evaluate Supported Assets

- Stablecoin options (USDC, USDT, DAI)

- Major cryptocurrencies (BTC, ETH)

- Platform-specific tokens for bonus rates

- Withdrawal flexibility for each asset

Step 4: Test With Small Amounts

Start with minimal deposits to evaluate:

- User interface quality

- Customer service responsiveness

- Actual payout timing and amounts

- Withdrawal process efficiency

Advanced Strategies for Maximum Returns

Strategy 1: The Stablecoin Ladder

Diversify across multiple platforms and stablecoins to reduce risk while maximizing yield:

- 40% USDC on Nexo (12% APY)

- 30% USDT on BlockFi (9% APY)

- 30% DAI on Compound (7% APY)

- Blended yield: 9.7% with reduced platform risk

Strategy 2: The Promotional Rate Chase

Monitor new platform launches and promotional offers:

- New user bonuses often exceed 15% APY for initial months

- Referral rewards can boost effective yields

- Limited-time rate increases for loyal users

Strategy 3: The Token Optimization Play

Many platforms offer higher rates when you hold their native tokens:

- Nexo tokens unlock premium interest tiers

- CEL tokens boost Celsius earnings by 1-2%

- Platform governance tokens often provide additional benefits

Regulatory Landscape: What’s Coming

United States: The SEC continues evaluating crypto lending as securities offerings. Expect clearer regulations by mid-2025 that could reshape the industry.

European Union: MiCA regulations took effect in 2024, providing regulatory clarity for EU-based platforms and potentially increasing user confidence.

Asia-Pacific: Countries like Singapore and Switzerland lead in crypto-friendly regulations, making their platforms increasingly attractive to international users.

Tax Implications You Can’t Ignore

Critical tax considerations:

- Interest income is taxable as ordinary income in most jurisdictions

- Daily compounding creates multiple taxable events

- Platform tokens may trigger additional capital gains obligations

- International platforms require careful reporting for tax compliance

Pro tip: Use crypto tax software like CoinTracker or TaxBit to automatically calculate your obligations from interest earnings.

Red Flags: Platforms to Avoid

Warning signs of problematic platforms:

- Unrealistic rates significantly above market averages

- Lack of transparency about lending activities

- Poor customer reviews focusing on withdrawal issues

- Regulatory problems or legal challenges

- Anonymous teams without verifiable backgrounds

Building Your Crypto Interest Portfolio

Beginner Allocation (Conservative):

- 60% regulated platforms (BlockFi, Gemini Earn)

- 40% established DeFi protocols (Compound, Aave)

- Target yield: 6-8% APY with lower risk

Intermediate Allocation (Balanced):

- 40% top-tier centralized platforms (Nexo, Celsius)

- 35% proven DeFi protocols

- 25% newer platforms with competitive rates

- Target yield: 8-12% APY with moderate risk

Advanced Allocation (Aggressive):

- 30% premium centralized platforms

- 40% high-yield DeFi strategies

- 30% emerging platforms and promotional rates

- Target yield: 12-18% APY with higher risk

FAQ: Your Most Pressing Questions Answered

Q: Are crypto interest accounts safe? A: Safety varies dramatically by platform. Regulated, insured platforms offer more protection, but no crypto interest account provides FDIC-level security. Never invest more than you can afford to lose.

Q: How do I calculate potential earnings? A: Use a crypto interest account calculator with your deposit amount, platform APY, and compounding frequency. Most platforms offer calculators on their websites.

Q: What’s the minimum deposit for most platforms?

A: Minimums range from $0 (Celsius) to $100 (BlockFi) to $1,000+ (institutional platforms). Start small to test platforms before larger commitments.

Q: Can I withdraw my crypto anytime? A: Most platforms allow instant withdrawals, but some impose daily limits or require advance notice. Always understand withdrawal terms before depositing.

Q: Do I need to pay taxes on crypto interest? A: Yes, in most countries crypto interest is taxable income. Track all earnings carefully and consult tax professionals for complex situations.

Q: Which cryptocurrencies offer the best interest rates? A: Stablecoins (USDC, USDT) typically offer the most attractive risk-adjusted returns, while volatile cryptocurrencies may provide higher nominal rates with significantly more risk.

The Future of Crypto Interest Accounts

Emerging trends shaping the industry:

- Institutional adoption driving more regulatory compliance

- DeFi integration creating more sophisticated yield strategies

- Cross-chain protocols enabling multi-blockchain optimization

- AI-powered risk assessment and yield optimization

- Traditional bank integration bringing crypto yields to mainstream finance

Market predictions for 2025:

- Increased regulatory clarity boosting user confidence

- More insurance options protecting user deposits

- Integration with traditional banking products

- Enhanced mobile experiences and automation features

You may also want to read about: 7 Places to Discover High Yield Savings Accounts with No Monthly Fees

Your Action Plan: Getting Started Today

Week 1: Research and Compare

- Study platform security reports and user reviews

- Compare rates using multiple best crypto interest account comparison sites

- Understand tax implications in your jurisdiction

- Set up accounts on 2-3 promising platforms

Week 2: Start Small

- Make initial deposits of $100-500 per platform

- Test user interfaces and customer service

- Monitor actual vs. advertised returns

- Evaluate withdrawal processes

Week 3: Scale and Optimize

- Increase deposits on platforms that perform well

- Implement diversification strategies

- Set up automated tracking and tax reporting

- Plan for quarterly rebalancing

The bottom line: Crypto interest accounts offer unprecedented opportunities for passive income generation, but success requires careful platform selection, risk management, and continuous monitoring.

Traditional savings accounts have become financial dead ends, paying rates that don’t even keep pace with inflation. Meanwhile, crypto interest accounts provide real opportunities to generate meaningful passive income that compounds daily.

The question isn’t whether you should explore crypto interest accounts – it’s how quickly you can start earning while others remain stuck in the traditional banking stone age.

Ready to transform your savings strategy? Which platform intrigues you most, and what’s holding you back from getting started? Share your thoughts and questions in the comments below – let’s build a community of smart crypto savers who help each other navigate this exciting new financial landscape.

Remember: Cryptocurrency investing involves significant risk, including potential loss of principal. Never invest more than you can afford to lose, and always conduct thorough research before choosing any crypto interest account platform.

Pingback: how to convert currency in paypal

Pingback: SaaS Digital Asset Management