Are you tired of watching your hard-earned money sit in a traditional savings account earning pennies in interest? With inflation continuously eroding your purchasing power, finding high-yield savings accounts has never been more crucial. The good news? You can now discover high yield savings options that not only offer competitive rates but also come with no monthly fees, allowing you to keep more of what you earn.

What if I told you that simply moving your emergency fund or savings from a traditional bank to one of these high-yield options could multiply your interest earnings by 10x or more? For many Americans making this switch, the difference has meant hundreds or even thousands of extra dollars annually—money that was previously being left on the table.

In this comprehensive guide, I’ll walk you through the seven best places to discover high yield savings accounts that combine exceptional interest rates with no monthly maintenance fees, helping your money work harder without additional costs.

Why Traditional Savings Accounts Are Costing You Money

Before diving into our top recommendations, let’s understand why traditional savings accounts at brick-and-mortar banks are essentially diminishing your wealth:

According to recent data from the FDIC, the national average interest rate for savings accounts at traditional banks hovers around 0.45% APY (Annual Percentage Yield) as of May 2025. Meanwhile, inflation has been running at approximately 3.2% over the past year.

This means that money parked in average savings accounts is losing about 2.75% of its purchasing power annually. On a $10,000 balance, that translates to a loss of $275 in real value every year.

In stark contrast, the high-yield savings accounts featured in this guide offer APYs ranging from 4.50% to 5.25%, potentially earning you $450-$525 annually on that same $10,000 balance—effectively outpacing inflation and actually growing your wealth.

What Makes a High-Yield Savings Account Truly Fee-Free?

Before exploring specific options, it’s important to understand what “no monthly fees” truly means. The best accounts eliminate these common charges:

- Monthly maintenance fees: Typically $5-15 per month at traditional banks

- Minimum balance fees: Charged when your balance falls below a certain threshold

- Excessive transaction fees: Beyond the federally allowed six withdrawals per month

- Account opening fees: One-time charges to establish your account

- Account closing fees: Penalties for closing your account early

True no-fee high-yield savings accounts eliminate these charges while still providing premium interest rates and features.

Top 7 Places to Discover High Yield Savings With No Monthly Fees

After analyzing dozens of financial institutions based on their interest rates, fee structures, customer service ratings, and account features, here are the seven best places to park your savings in 2025:

1. Discover Bank High Yield Savings

Discover Bank high yield savings consistently ranks among the top options for fee-conscious savers.

Current APY: 4.90% (as of May 2025) Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- 24/7 U.S.-based customer service

- Highly-rated mobile app (4.8/5 stars with over 1.5 million reviews)

- FDIC insurance up to $250,000

- No fees whatsoever (including no insufficient funds fees)

Discover savings account APY has remained consistently competitive, even as rates have fluctuated in response to Federal Reserve actions. Their transparent policy of no hidden fees makes this account particularly attractive for those who want simplicity without sacrificing earnings.

Real customer experience: “I switched to Discover high yield savings after paying nearly $200 in annual fees at my traditional bank. Not only did I eliminate those fees, but my interest earnings increased by $327 in the first year alone.” — Michelle K., Accounts Manager

2. Capital One 360 Performance Savings

Current APY: 4.75% Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- Top-rated mobile app with intuitive savings tools

- No fees for any account management activities

- Automatic savings plans available

- Physical branch access in some locations (unlike most online banks)

Capital One’s hybrid model offers the convenience of some physical locations while still providing the higher yields typically associated with online-only banks.

3. Ally Online Savings Account

Current APY: 4.85% Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- “Buckets” feature for organizing savings goals within one account

- “Surprise Savings” that analyzes spending patterns and automatically transfers small amounts to savings

- 24/7 customer service with high satisfaction ratings

- Consistently competitive rates without promotional teaser rates

Ally Bank has built a strong reputation for user-friendly banking without sacrificing competitive yields, making it an excellent choice for technological simplicity.

4. American Express High Yield Savings

Current APY: 4.70% Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- Linked to American Express credit card rewards ecosystem

- 24/7 customer service from a trusted financial brand

- Easy transfers to external accounts

- Strong security features

American Express may not always offer the absolute highest savings account interest rates, but their consistency and security make them a solid choice, especially for existing Amex customers.

5. SoFi Checking and Savings

Current APY: 5.25% (with direct deposit requirement) Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- Highest APY on our list (with qualifying direct deposit)

- Hybrid checking and savings functionality

- Early paycheck access up to two days

- Cash bonuses for setting up direct deposit

SoFi offers the highest potential yield, but note that you’ll need to set up a qualifying direct deposit to receive the maximum rate. Without direct deposit, the rate drops to a still-competitive 4.50%.

6. Marcus by Goldman Sachs High-Yield Online Savings

Current APY: 4.80% Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- Backed by investment banking giant Goldman Sachs

- Intuitive financial tracking tools

- Same-day transfers up to $100,000

- Traditional banking stability with modern online convenience

Marcus offers a comfortable middle ground between traditional banking security and modern high-yield advantages.

7. Synchrony Bank High Yield Savings

Current APY: 4.75% Minimum opening deposit: $0 Monthly fees: None Minimum balance requirement: $0

Standout features:

- Optional ATM card for easier cash access

- Unlimited ATM fee reimbursements

- Perks program with increasing benefits based on balance and tenure

- Consistently competitive rates without requiring additional products

The ATM access option makes Synchrony unique among high-yield accounts, providing a benefit rarely seen in online savings products.

Comparing Discover High Yield Savings Account vs Competitors

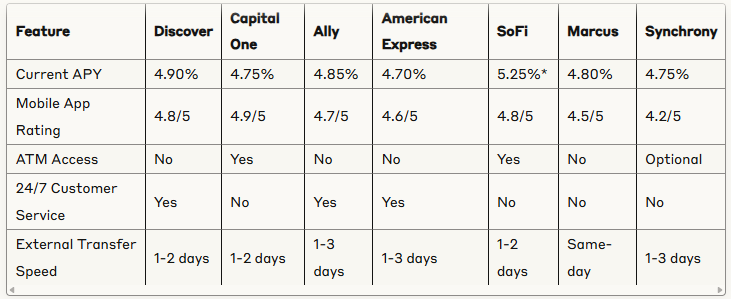

While all seven options offer excellent value, Discover high yield savings account vs competitors reveals some key differentiating factors:

*With qualifying direct deposit; 4.50% without

As this comparison shows, Discover Bank high yield savings offers an excellent balance of high APY, outstanding customer service, and user-friendly technology.

Discover High Yield Savings Account Review: A Closer Look

Given Discover’s position as a standout option, let’s dive deeper into a Discover high yield savings account review to understand what makes it particularly appealing:

Opening Process and Minimum Deposit

The Discover high yield savings account minimum deposit is $0, meaning you can open an account without an initial deposit. This accessibility makes it ideal for those just starting their savings journey.

The account opening process is entirely online and typically takes less than 10 minutes if you have your personal information ready (SSN, address, identification, etc.).

Interest Rate Competitiveness and Consistency

The Discover high yield savings interest rate has historically remained within the top tier of offerings. While some competitors occasionally offer slightly higher promotional rates, Discover has maintained consistent competitive rates without teaser periods that later drop.

Interest compounds daily and is credited monthly, maximizing your earning potential.

Fee Structure and Transparency

The Discover high yield savings account fees structure is refreshingly simple: there are none. This includes:

- No monthly maintenance fees

- No minimum balance fees

- No excessive transaction fees (beyond the six withdrawals federally allowed)

- No ACH transfer fees

- No account closure fees

This transparency provides peace of mind, knowing your entire balance is working for you.

Account Access and Management

Discover’s online platform and mobile app consistently receive high marks for usability. Features include:

- Intuitive dashboard showing interest earned

- Easy external account linking

- Automated savings options

- Secure document delivery

- Quick money transfers between accounts

Customer Service Excellence

Discover high yield savings account customer service regularly earns industry recognition, offering:

- 24/7 U.S.-based phone support

- Secure messaging within online banking

- Comprehensive online knowledge base

- Quick response times (typically under 2 minutes for phone)

In J.D. Power’s 2024 Direct Banking Satisfaction Study, Discover ranked among the top three for customer satisfaction, highlighting their commitment to service excellence.

How to Maximize Your Discover High Yield Savings Account

Once you’ve opened your account, these strategies will help you make the most of it:

1. Set Up Automatic Transfers

Establishing regular automatic transfers from your checking account helps build your savings consistently and takes advantage of dollar-cost averaging into higher rates.

Implementation strategy: Start with an amount you won’t notice missing from your checking account, even if it’s just $25-50 per paycheck. Gradually increase this amount as your comfort level grows.

2. Use the Account Appropriately

High-yield savings accounts work best for specific financial goals:

- Emergency funds (3-6 months of expenses)

- Short-term savings goals (1-5 years)

- Cash you need accessible but don’t need immediately

Remember that federal regulations still limit most savings accounts to six withdrawals per month, so this shouldn’t be used like a checking account.

3. Leverage Account Bonuses

Watch for Discover high yield savings account bonus offers, which periodically provide cash incentives for new deposits. These bonuses, often ranging from $150-300, can significantly boost your initial returns.

Bonus timing tip: These promotions are typically more common during the first and second quarters of the year. Setting calendar reminders to check for bonus offers in January and April could lead to additional earnings.

4. Maintain a Relationship

While the Discover savings account has no minimum balance requirements, maintaining a healthy balance and adding regular deposits often qualifies you for better customer service and occasional targeted offers.

5. Pair With Complementary Accounts

Consider combining your high-yield savings with a Discover checking account for seamless transfers and a unified banking experience. The Discover Cashback Debit account even offers 1% cashback on debit purchases (up to $3,000 monthly), providing additional returns on your spending.

Common Questions About Discover High Yield Savings

How does Discover offer higher rates than traditional banks?

Discover online savings account offerings can provide higher APYs than brick-and-mortar banks because of their lower overhead costs. Without physical branches to maintain, online banks can pass these savings to customers through higher interest rates and lower fees.

Is my money safe in a Discover high-yield account?

Yes, Discover Bank is FDIC insured up to $250,000 per depositor, providing the same government-backed protection as traditional banks. This insurance means your deposits are secure even in the unlikely event of bank failure.

How quickly can I access my money if needed?

Transfers from your Discover savings to external bank accounts typically take 1-2 business days. If you also have a Discover checking account, transfers between these accounts are instant, providing faster access to your funds in emergencies.

Are there any hidden catches to the “no fees” promise?

No, Discover’s no-fee commitment is comprehensive. The only charges you might encounter are those mandated by law, such as excess withdrawal penalties if you exceed the federally allowed six withdrawals per month. Even these are currently waived during the ongoing review of this regulation.

Will my rate drop significantly after opening the account?

Unlike some banks that offer teaser rates, Discover maintains consistent competitive rates for all customers. While rates may change based on the Federal Reserve’s decisions, these changes affect all customers equally, not just new ones.

Is a Discover High Yield Savings Account Right for You?

While Discover high yield savings offers tremendous advantages, determining if it’s the perfect fit depends on your specific financial situation:

Ideal for:

- Savers who prioritize eliminating fees

- Those comfortable with online/mobile banking

- People seeking competitive, consistent rates

- Customers who value 24/7 U.S.-based customer service

- Savers who don’t need branch access

May not be ideal for:

- Those who frequently require in-person banking services

- People who need to make more than six withdrawals monthly

- Customers who prefer to consolidate banking with investment services

- International residents (accounts available to U.S. residents only)

The Power of Compound Interest: Why Starting Today Matters

The magic of high-yield savings accounts comes from compound interest—earning interest on both your principal and previously earned interest.

Let’s illustrate the difference between a traditional bank savings account and a Discover high yield savings account with a $10,000 initial deposit and $200 monthly contributions over five years:

Traditional Bank (0.45% APY):

- Initial deposit: $10,000

- Monthly contribution: $200

- After 5 years: $22,240

- Total interest earned: $240

Discover High Yield Savings (4.90% APY):

- Initial deposit: $10,000

- Monthly contribution: $200

- After 5 years: $25,732

- Total interest earned: $3,732

The difference? An additional $3,492 in your pocket simply by choosing a high-yield account.

This example powerfully demonstrates why making the switch to higher-yielding accounts isn’t just a minor financial decision—it’s a significant wealth-building opportunity over time.

How to Open a Discover High Yield Savings Account

Ready to start earning more on your savings? Here’s a step-by-step guide to opening an account:

1. Prepare Your Information

- Social Security Number

- Valid government-issued ID

- Address history

- Employment information

- External bank account details for funding

2. Complete the Online Application

- Visit Discover’s website or download their mobile app

- Select the High-Yield Savings product

- Fill out the application form (typically takes 5-10 minutes)

- Verify your identity through the secure online process

3. Fund Your Account

- Set up an electronic transfer from an existing bank account

- Establish direct deposit from your paycheck

- Mail a physical check if preferred

4. Set Up Online Access

- Create your online banking credentials

- Download the mobile app

- Enable security features like two-factor authentication

5. Optimize Your Account

- Set up automatic transfers

- Establish savings goals

- Link external accounts for easy transfers

The entire process typically takes less than 15 minutes, with account access granted immediately after verification. Initial transfers may take 1-3 business days to complete.

Conclusion: Time to Upgrade Your Savings Strategy

In an economic environment where every dollar matters, continuing to use low-yield traditional savings accounts means voluntarily giving up hundreds or thousands in potential interest earnings. The seven no-fee high-yield options presented here—particularly the Discover high yield savings account—offer a compelling alternative without adding costs or complexity to your financial life.

By making the simple decision to move your savings to one of these accounts, you’re not just earning more interest—you’re adopting a more intentional approach to your financial wellbeing. The combination of eliminated fees and multiplied interest creates a powerful wealth-building tool that works silently in the background of your life.

You may also want to read about : Crypto.com Twitter Engagement Hacks: What Marketers Can Learn from Crypto Brands

Are you ready to discover high yield savings opportunities for your hard-earned money? The financial difference can be substantial, and with today’s streamlined online account opening processes, you’re just minutes away from putting your money to work more effectively.

Have you already made the switch to a high-yield savings account? Which features have proven most valuable to you? Share your experiences in the comments below to help fellow readers make informed decisions about their savings strategies.