You’ve been promised the dream: park your money in a high-yield savings account and watch it grow effortlessly. But what if I told you that beneath those attractive APY rates lurk hidden traps that could cost you thousands?

Picture this: Sarah, a freelance graphic designer, thought she’d struck gold when she moved her $50,000 emergency fund to discover high yield savings account promising 4.5% APY. Six months later, she discovered fees and restrictions that ate into her returns more than her old brick-and-mortar bank ever did.

You’re not alone if you’ve been seduced by those eye-catching interest rates plastered across financial websites. But before you make the leap, let’s pull back the curtain on what banks don’t advertise in their glossy marketing campaigns.

The Allure That’s Hard to Resist

When you discover online savings account options offering 10-15 times more interest than traditional banks, it feels like finding money on the sidewalk. According to the FDIC’s latest data from 2024, the average savings account APY sits at a measly 0.45%, while top-tier high-yield accounts boast rates exceeding 5.00%.

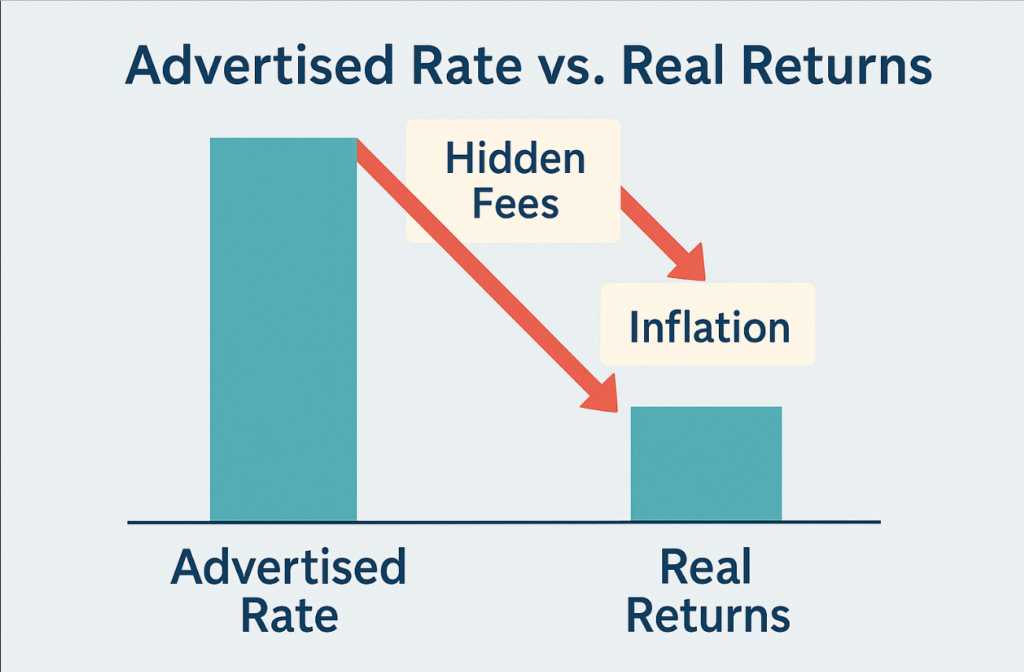

The math seems simple: More interest equals more money in your pocket, right?

Not so fast.

How to Track and Manage Your Cryptocurrency Portfolio: Tips for Investors

Hidden Risk #1: The Variable Rate Trap

Here’s what they don’t tell you upfront: that attractive Discover Bank high yield savings rate you fell in love with? It can change overnight.

Unlike certificates of deposit with locked rates, high-yield savings accounts feature variable APYs that fluctuate with market conditions and the bank’s business decisions. When the Federal Reserve cut rates in 2020, many savers watched their “high-yield” accounts drop from 2.2% to 0.6% within months.

Real-World Impact:

- Marcus by Goldman Sachs: Dropped from 2.25% to 0.50% between March-May 2020

- Ally Bank: Fell from 2.20% to 0.50% during the same period

- Capital One 360: Decreased from 2.00% to 0.40%

Your $25,000 emergency fund that was earning $562 annually suddenly generated just $125 – a 78% reduction in passive income.

Hidden Risk #2: Promotional Rate Bait and Switch

Many banks lure new customers with promotional rates that disappear faster than free samples at Costco. That discover high yield savings interest rate advertised everywhere might only apply to your first few months as a customer.

Common promotional tactics include:

- Introductory bonuses lasting 3-6 months

- New customer rates that revert to standard APY

- Balance tier requirements where high rates only apply to specific deposit amounts

Case Study: The $10,000 Mistake

James opened a discover high yield savings account with a 5.2% promotional rate, planning to keep $10,000 there long-term. After six months, his rate dropped to 1.8% without notification. He lost $340 in expected annual interest because he didn’t read the fine print about promotional periods.

Hidden Risk #3: Access Limitations That Cost You Money

Federal Regulation D limits you to six withdrawals per month from savings accounts. Exceed this limit, and banks can:

- Charge penalty fees ($10-25 per transaction)

- Convert your account to checking (often with lower rates)

- Close your account entirely

For online entrepreneurs managing irregular income streams, these restrictions can be financially devastating during cash flow emergencies.

Hidden Risk #4: The Minimum Balance Minefield

That discover high yield savings account minimum deposit requirement isn’t just a one-time hurdle. Many accounts impose ongoing minimum balance requirements that can:

- Trigger monthly fees if you fall below thresholds

- Reduce your APY to near-zero rates

- Close your account automatically

The Hidden Math:

If your account requires a $2,500 minimum balance but charges a $12 monthly fee when you drop below that threshold, you’re paying $144 annually – potentially wiping out interest earnings on smaller balances.

Hidden Risk #5: Customer Service Nightmares

Online-only banks offering the highest rates often sacrifice customer service quality. When you need help, you might face:

- Long hold times (average 45+ minutes during peak periods)

- Limited phone support hours

- No physical branches for complex issues

- Outsourced support with limited problem-solving authority

According to J.D. Power’s 2024 U.S. Direct Banking Satisfaction Study, online-only banks scored 23 points lower than traditional banks in customer satisfaction.

Hidden Risk #6: Technology Risks and Outages

Your money lives in the digital cloud, making you vulnerable to:

- Website crashes during market volatility

- Mobile app failures when you need access most

- Cybersecurity breaches exposing personal data

- System maintenance blocking account access

Real example: In March 2024, a major online bank experienced a 6-hour outage that prevented customers from accessing funds during a market downturn, causing significant stress and potential missed opportunities.

The Compound Interest Illusion

Banks love advertising compound interest benefits, but they don’t mention that inflation can erode your purchasing power faster than interest accumulates.

With 2024 inflation rates hovering around 3.2%, that 4.5% APY on your discover savings account APY only provides a real return of approximately 1.3% after accounting for inflation – barely beating the historical average.

Smart Alternatives to Consider

1. High-Yield CD Laddering

Lock in guaranteed rates while maintaining some liquidity through staggered maturity dates.

2. Treasury Bills and Bonds

Government-backed securities offering competitive rates with tax advantages on state income.

3. Money Market Accounts

Combining savings rates with checking account flexibility, though with their own limitations.

4. High-Yield Checking Accounts

Select credit unions offer checking accounts with savings-level rates and better access.

Red Flags to Watch For

Before you discover high yield savings account options, scrutinize these warning signs:

- Rates significantly higher than competitors (often unsustainable)

- Complex fee structures buried in terms and conditions

- Poor online reviews focusing on customer service issues

- New banks without established track records

- Unclear promotional terms regarding rate changes

Making the Smart Choice: A Step-by-Step Strategy

Step 1: Calculate True Returns

Factor in all fees, minimum balances, and promotional periods to determine actual earnings.

Step 2: Diversify Your Savings Strategy

Don’t put all funds in one account type. Spread risk across multiple vehicles.

Step 3: Read the Fine Print

Understand withdrawal limitations, fee structures, and rate change policies before depositing.

Step 4: Set Up Alerts

Monitor your account regularly for rate changes, fee assessments, and balance requirements.

Step 5: Have a Backup Plan

Maintain relationships with multiple financial institutions for flexibility.

The Truth About Discover High Yield Savings Account Reviews

While researching discover high yield savings account review content, you’ll find mixed experiences. Positive aspects include competitive rates and user-friendly interfaces. Negative feedback often centers on customer service delays and unexpected fee assessments.

Key statistics from 2024 customer surveys:

- 67% satisfaction rate for online-only high-yield accounts

- 23% of customers experienced unexpected fees in their first year

- Average customer service resolution time: 8.2 business days

FAQ: Your Burning Questions Answered

Q: Are high-yield savings accounts FDIC insured? A: Yes, legitimate high-yield savings accounts carry FDIC insurance up to $250,000 per depositor, per bank. Always verify FDIC membership before depositing.

Q: Can I lose money in a high-yield savings account? A: While your principal is protected by FDIC insurance, you can lose purchasing power to inflation and pay more in fees than you earn in interest with poor account management.

Q: How often do interest rates change on high-yield accounts? A: Banks can change rates at any time without advance notice. Most adjust rates monthly based on Federal Reserve decisions and competitive pressures.

Q: What’s the difference between APY and interest rate? A: APY (Annual Percentage Yield) includes compound interest effects, while interest rate is the simple annual rate. Always compare APYs when shopping for accounts.

Q: Are there tax implications for high-yield savings interest? A: Yes, all interest earned is taxable as ordinary income. Banks report earnings over $10 annually to the IRS via Form 1099-INT.

The Bottom Line: Knowledge Is Your Best Investment

High-yield savings accounts aren’t inherently evil, but they’re not the financial panacea that marketing departments want you to believe. Like any financial tool, they work best when you understand their limitations and use them strategically.

You may also want to read about: Is Fidelity Crypto Safe for Beginners? A 2025 Review

Your takeaway action plan:

- Research discover high yield savings account vs competitors thoroughly

- Calculate real returns after fees and inflation

- Diversify your savings across multiple account types

- Monitor your accounts monthly for changes

- Keep emergency funds accessible through multiple channels

The path to financial independence isn’t paved with any single savings account – it’s built through informed decisions, diversified strategies, and constant vigilance against financial institutions that profit from your ignorance.

What’s your experience been with high-yield savings accounts? Have you encountered any of these hidden risks, or discovered others we haven’t covered? Share your story in the comments below – your experience could save another reader from costly mistakes.

Remember: The best savings account is the one that aligns with your specific financial goals, risk tolerance, and liquidity needs. Don’t let attractive rates blind you to potential pitfalls that could cost you more than you earn.

Pingback: convert currency paypal